【鄭博仁律師事務所】加州調漲最低工資標準

鄭博仁聯合律師事務所California’s minimum wage increases

If you are not in L.A city or in an unincorporated city of L.A. County and don’t have a local city ordinance the following will apply to you:

Large businesses with 26 or more employees will begin complying in 2017 and will reach $15 per hour in 2022. Small businesses with 25 or fewer employees will not be required to begin the scheduled increases until 2018 and will have until 2023 to reach the $15 per hour rate.

Date Employers With 26 or More Employees / Employers With 25 or Fewer Employees:

01/01/2017 $10.50 per hour / $10 per hour

01/01/2018 $11 per hour / $10.50 per hour

01/01/2019 $12 per hour / $11 per hour

01/01/2020 $13 per hour / $12 per hour

01/01/2021 $14 per hour / $13 per hour

01/01/2022 $15 per hour / $14 per hour

01/01/2023 $15 per hour / $15 per hour

Until the minimum wage reaches $15 per hour, the governor has the authority to suspend increases based on current economic conditions. However, this is discretionary and would happen only if there are declining state revenues from sales tax; there is a decline in the labor market; or there is a budget deficit (this decision to suspend is permitted to occur only twice).

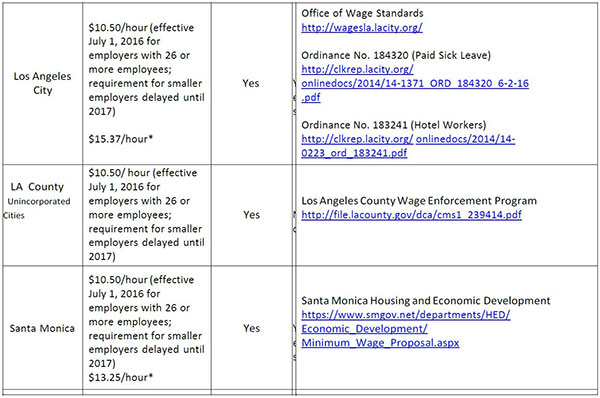

Local City Ordinances

Los Angeles ‘City’ New Paid Sick Time

The Los Angeles City Council has voted and the Mayor has signed the ordinance. As of July 1, 2016, many employees within the City of Los Angeles will be entitled to accrue 48 hours of paid sick leave per year. Link to the Ordinance here.

The minimum wage provisions of the ordinance distinguish between larger employers (26 or more employees) and smaller employers (25 or fewer employees) for implementation timing—smaller employers have until July 1, 2017. It is uncertain from the text whether a similar grace period before implementation of paid sick leave for exists for smaller employers.

Details of the ordinance are below:

SEC. 187.04. SICK TIME BENEFITS.

A. Every Employee who, on or after July 1,2016, works in the City for the same Employer for 30 days or more within a year from the commencement of employment is entitled to paid sick leave.

B. Paid sick leave shall accrue on the first day of employment or July 1, 2016, whichever is later.

C. An Employee may use paid sick leave beginning on the 90th day of employment or July 1,2016, whichever is later.

D. Employers must provide sick leave either: 1) by providing the entire 48 hours to an Employee at the beginning of each year of employment, calendar year, or 12-month period; or 2) by providing the Employee one hour of sick leave per every 30 hours worked.

E. Employees will be entitled to take up to 48 hours of sick leave in each year of employment, calendar year, or 12-month period. Accrued unused paid sick leave shall carry over to the following year of employment and may be capped at 72 hours. An Employer may set a higher cap or no cap at all.

F. If an Employer has a paid leave or paid time off policy or provides payment for compensated time off, that is equal to or no less than 48 hours, no additional time is required.

G. An Employer shall provide paid sick leave upon the oral or written request of an Employee for themselves or a family member, as defined by California Labor Code Sections 246.5(a) and 245.5(c), or for any individual related by blood or affinity whose close association with the employee is the equivalent of a family relationship. An Employer may require an Employee to provide reasonable documentation of an absence from work for which paid sick leave is or will be used.

H. An Employer is not required to provide compensation to an Employee for accrued or unused sick days upon termination, resignation, retirement, or other separation from employment.

I. If an Employee separates from an Employer and is rehired by the Employer within one year from the date of separation, previously accrued and unused paid sick time shall be reinstated.

Federal Overtime Rule Published

The U.S. Department of Labor (DOL) announced the highly anticipated federal overtime rule under the Fair Labor Standards Act (FLSA). The final rule is effective December 1, 2016.

The final rule changes the salary level that must be met before an employee can be exempt from overtime under one of the so-called white-collar exemptions (executive, administrative and professional).

The minimum salary threshold will increase to $913 per week, $47,476 annually for a full-time worker. An employee paid less than this threshold amount will be guaranteed overtime pay. This threshold is higher than California’s minimum annual salary threshold for the white-collar exemptions, which is currently $41,600.

Effective December 1, an employee will need to meet the higher federal salary threshold of $913 per week to be classified as exempt under both California and federal law. California employees must continue to meet California’s strict duties test, in addition to the salary test.

Employers have options to respond to the federal overtime rule, including: (1) raising employees’ salaries to meet the new threshold; or (2) reclassifying positions to nonexempt and paying overtime and complying with other rules, such as meal- and rest-break requirements, that govern nonexempt employees.

Employers who reclassify employees should make sure that the newly nonexempt employees understand California-specific rules, such as rules on meal and rest breaks and timekeeping.

Employers concerned about limiting overtime will also need to plan ahead. Navigating the terrain between California and federal rules can be complicated. Employers must comply with the law that gives the most protection to the employee.

Poor Recordkeeping Increases Overtime Liability

A recent U.S. Supreme Court decision highlights one of the many dangers of not keeping proper records of time worked and wages paid: you might not be able to defend yourself if you’re sued by employees who claim you didn’t pay them the right amount.

The Supreme Court upheld a $5.8 million verdict for unpaid overtime against a large food company. The underlying case involved workers in a pork-processing plant in Iowa who claimed that time spent “donning and doffing” (changing into required protective clothes/gear), washing up and walking to and from their work stations lengthened their workweek and entitled them to overtime pay.

The company didn’t keep complete and adequate time and pay records, so the Court allowed the workers to use an expert’s averaging and statistics to show they weren’t paid the right amount.

Remember, California employers are required by law to keep accurate time and payroll records, and there are penalties for failing to do so.

Workplace Safety Corner

Safety in the workplace has received much attention!

Smoking Ban Extended

Governor Brown signed a package of bills that changed the rules relating to smoking in the workplace and expanded already-existing, smoke-free workplace protections. These rules became effective on June 9, 2016.

New legislation:

• Treats the use of e-cigarettes and other nicotine-delivery devices, such as vaporizers, as “smoking” — thus extending existing smoking bans to cover such products.

• Expands smoke-free workplace protections by getting rid of most of the existing exemptions that permitted smoking in certain work environments, such as bars, hotel lobbies and warehouse facilities.

• Eliminates the ability to have employer-designated smoking break rooms.

• Expands the workplace smoking ban to include owner-operated businesses and to eliminate any small business exception for employers with five or fewer employees.

• Raises the legal smoking age from 18 to 21, except for active military personnel.

Employers will want to review existing workplace smoking policies to ensure compliance with the new law. Consult legal counsel if you think an exemption might apply to your place of work.

Working Conditions

Suitable Seating Addressed by Supreme Court

The California Supreme Court issued a long-awaited decision on the issue of when an employer must provide “suitable seats” to an employee. The majority of California’s Wage Orders require “suitable seats when the nature of the work reasonably permits the use of seats.”

But questions lingered about how to apply this requirement, and workers, such as bank tellers and cashiers, filed class-action lawsuits over when seating was required.

The state Supreme Court ruled: If the tasks performed at a given location reasonably permit sitting and providing a seat would not interfere with the performance of any other tasks that may require standing, a seat is called for.

To determine whether the nature of the work “reasonably permits” use of a seat at a particular location, courts will also look at the totality of circumstances, including:

• The relationship between standing and sitting tasks;

• The frequency and duration of those tasks with respect to each other;

• Whether providing a seat would unduly interfere with other standing tasks;

• Whether the frequency of transition from sitting to standing may interfere with the work; and

• Whether seated work would affect the quality and effectiveness of overall job performance.

An employer’s business judgment, customer service considerations and the physical layout of the workspace are all relevant to the issue of whether a seat must be provided, but the weight given to any factor by a court will depend on the circumstances. An employer’s “mere preference” that tasks be performed while standing is not enough.

Constructive Discharge Claims: When Does the Clock Start Ticking?

An employee who resigns in the face of intolerable discriminatory or harassing working conditions can bring a claim for wrongful termination, known as “constructive discharge.” In May, the U.S. Supreme Court held that the time period for filing a constructive discharge claim begins when the employee gives definite notice of his/her resignation.

A court case resolved a split between federal circuit courts: some ruled that the clock started at the time of resignation, and others ruled that it started at the time of the last allegedly discriminatory act giving rise to the resignation.

Rounding Practices OK if Neutral

California law requires employers to keep accurate records reflecting the hours their employees work. Sometimes, the legality of an employer’s “rounding” of timecard entries comes into question.

In a recent decision, a federal court confirmed that a company can round nonexempt employee time up to the nearest quarter-hour as long as the practice is neutral both on its face and in practice-meaning that, over time, the practice doesn’t favor either the employer or the employee.

Further, one minute of uncompensated time was determined “de minimis” and, thus, was not compensable time.

No Combined Rest Breaks

A California court affirmed that, in general, rest breaks cannot be combined.

The case involved employees at a metal-finishing company who worked eight-hour shifts and were provided one 30-minute meal break and one combined 20-minute rest break, which occurred either before or after the meal break.

California Supreme Court’s guidance in the appellate court ruled that “rest breaks in an eight hour shift should fall on either side of the meal break, absent factors rendering such scheduling impracticable.” A company has no right to combine rest breaks as a matter of law.