鄭博仁律師:New Salary Requirement for Exempt Employees

11/17/2016 鄭博仁聯合律師事務所

The Fair Labor Standards Act (FLSA) requires that employers pay eligible nonexempt employees an overtime premium of at least 1.5 times their regular rate of pay for hours worked over 40 in a workweek.

Soon, overtime protections may be available to far more employees under a proposed rule to revise the federal overtime rule, and increase the salary threshold for the executive, administrative, and professional white collar exemptions from the overtime provisions.

Salary and compensation levels needed for executive, administrative, and professional workers to be exempt will increase to $47,476 per year effective December 1, 2016. To be in compliance with the new salary requirement, all exempt employees should earn at least $913 per week.

The New Rule includes:

Increase to the salary threshold from $23,660 to $47,476 a year, or from $455 to $913 a week. While this doubles the current salary threshold, it is also responsive to public comments, and sets the salary threshold at the 40th percentile of full-time salaried workers in the lowest income Census region (currently the South)

Updates the salary threshold every three years to ensure the threshold is maintained at the 40th percentile of full-time salaried workers in the lowest income region of the country. Based on projections of wage growth, the threshold is expected to rise to more than $51,000 with the first update on January 1, 2020.

Raise the “highly compensated employee” (HCE) annual salary threshold – from $100,000 to $134,004.

Makes no changes to the “duties test” under the white collar exemptions; workers earning more than the salary threshold are still subject to the duties test to determine eligibility for overtime.

Allows bonuses and incentive payments to count toward up to 10 percent of the new salary level.

Future automatic updates to those thresholds will occur every three years, beginning on January 1, 2020.

DOL links to information:

Wage and Hour Division Overtime Fact Sheet

Questions and Answers

Due to this proposed rule, businesses may face increasing payroll costs and the potential for expanded recordkeeping requirements for certain employees. That’s why we’ve assembled this guide to provide you with an overview of the FLSA, how your company might be impacted by the proposed rule, and what you can do to prepare.

The FLSA is a federal law that includes standards for minimum wage and overtime pay for covered employees. Before we dive into the proposed rule to change the salary thresholds for exemption from those standards and how it may affect your business, it’s important to understand what the FLSA does and does not address:

FLSA Coverage

Now let’s review who’s actually covered by the FLSA provisions. The FLSA covers more than 130 million workers, both full time and part time, in both the private and public sectors. Employees may be covered under the FLSA by the Enterprise Rule (by working for a covered employer) or the Individual Employee Coverage Rule.

Enterprise Rule

The Enterprise Rule applies to employees working for:

• employers with at least $500,000 in annual sales who have two or more employees engaged in interstate commerce or the production of goods for interstate commerce, or handling, selling, or working on goods or materials that have been moved in or produced for interstate commerce, or

• employers that are a hospital, nursing home, preschool, elementary or secondary school, college, or a federal, state, or local government agency.

Individual Employee Coverage Rule

The Individual Employee Coverage Rule applies to employees whose own actions involve the handling or production of goods for interstate commerce.

Non-Exempt vs. Exempt Employees

Even though an employee may be covered under the FLSA, they may be exempt from some or all of the provisions of the law and its regulations.

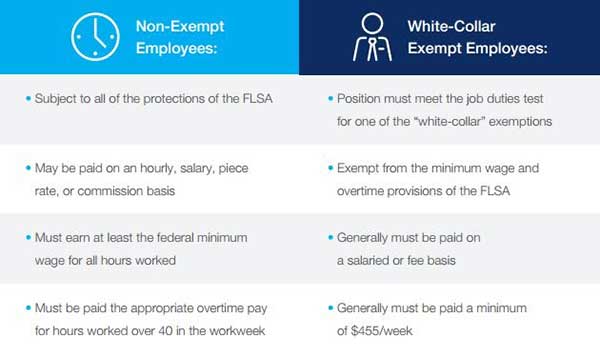

A covered employee who is eligible for all the protections of the FLSA is considered to be a non-exempt employee. Other covered employees may be exempt from some or all of the protections of the FLSA. You may be familiar with the “white-collar” exemptions. Employees who meet the requirements for these exemptions are exempt from the minimum wage and overtime provisions of the FLSA.

Here’s a look at some of the differences between non-exempt employees and employees who meet the criteria for one of the white-collar exemptions:

Highly Compensated Employee Exemption

The Highly Compensated Employee exemption is another exemption under the FLSA. These are employees who are also exempt from the Act. They must:

• have total annual compensation of at least $100,000/year

• be paid at least $455/week on a salary basis

• perform office or non-manual work, and

• customarily and regularly perform one or more of the exempt duties identified in the standard tests for executive, administrative, or professional exemptions.

Some states have their own provisions for exemption from overtime. Employees must be exempt under both state and federal law to avoid minimum wage and overtime requirements.

Overtime

As we’ve already learned, overtime is one of the key provisions of the FLSA. But with proposed changes on the horizon, let’s review what overtime pay entails.

Employers are required to pay an overtime premium to non-exempt employees for all hours worked in excess of 40 hours in a workweek. That premium is a rate of at least 1.5 times the employee’s regular rate of pay, regardless of the employee’s basis of pay — hourly, salary, piece rate,

commission, or any combination there of.

The regular rate of pay is determined by dividing the employee’s total compensation for the week, including their wages, non-discretionary bonus, and commission payments where applicable, by the total number of hours worked in that week. The hourly rate for overtime would then be 1.5 times that regular rate.

In determining overtime rates, employers must count all hours worked by the employee in the workweek.

Hours worked includes any work carried out by the employee, even if the work was not requested by the employer. Hours worked includes all compensable time. Compensable time may include:

• travel time

• time spent in lectures, meetings, and training

• breaks and meal periods

• waiting time or on-call time, and

• sleeping time.

The criteria for the determination of compensable time can be fact-specific so you may want to consult a labor and employment attorney, or the DOL’s fact sheet on hours worked under the FLSA.

Overtime pay cannot be waived by the employee. If the employee works the time, the employee must be paid for that time in accordance with the FLSA and applicable state law.

The Proposed Changes

On July 6, 2015, the DOL released a proposed rule to revise the minimum salary thresholds for the executive, administrative, and professional exemptions under the FLSA. The proposed changes include:

• An increase to the minimum salary level for exempt workers in the executive, administrative, and professional exemptions

-The threshold would be indexed to the 40th percentile of the weekly earnings for full-time salaried workers. For 2016 the threshold would increase from $455/week ($23,660/year) to $970/week or $50,440/year.

• The total annual compensation requirement needed to meet the highly compensated

employees (HCEs) exemption would increase from $100,000/year to $122,148/year.

• Salary thresholds for the executive, administrative, and professional exemptions would be adjusted annually.

-The rule proposes various methods on how to accomplish this, including the use of a fixed percentile of wages or the Consumer Price Index.

Making a Plan

A final rule is expected in the coming months with an effective date within 60– 90 days of its publication. While this may seem like enough time to adapt, these changes may result in difficult decisions and administrative tasks that can quickly consume your schedule.

That’s why it’s important to have a plan in place before these changes take effect. It’s possible the final rule may differ from what the DOL has proposed, but with a solid plan, you can make the necessary adjustments to help mitigate disruption to your business operations.