鄭博仁律師:2017年新就業法

01/04/2017 鄭博仁聯合律師事務所New Employment Laws for 2017

It’s time to talk new employment laws for 2017.

Unless specified, all new legislation goes into effect on January 1, 2017. This year, quite a few bills feature delayed or phased-in implementation.

| Wage and Hour |

Several new California laws will affect employers' wage-and-hour obligations in 2017.

California’s Upcoming Minimum Wage Increase – Review Your Practices

Make sure you examine all pay practices affected by the minimum wage increase!

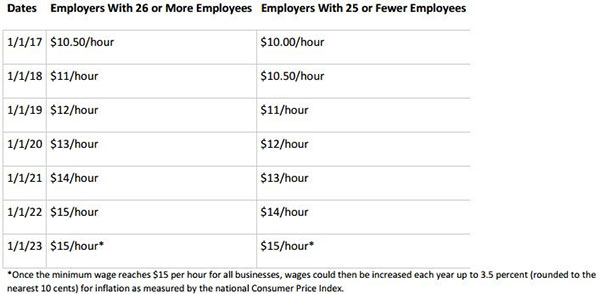

On January 1, 2017, California’s minimum wage increases to $10.50 per hour for businesses with 26 or more employees. Small businesses with 25 or fewer employees will continue to pay the current minimum wage of $10 per hour.

The increase for larger businesses is a result of SB 3, a bill that will increase the minimum wage in California to $15 per hour by 2022. Small businesses will not be required to begin the scheduled increases until 2018 and will have until 2023 to reach the $15 per hour rate.

Employers need to be ready for the minimum wage increase. Also, employers should remember that state enforcement agencies have made it a top priority to stop employers from engaging in so-called “wage theft,” which includes not paying the minimum wage for all hours worked.

Employers should examine all pay practices that might be affected by the minimum wage increase. Hint: There are more than you might think!

Practices that may need review include overtime rates of pay, exempt/nonexempt classifications, meal and lodging credits, commission issues, notice requirements and more.

California Minimum Wage Chart:

Itemized Wage Statements

AB 2535 amends Labor Code Section 226 and clarifies that employees who are exempt from the payment of minimum wage and overtime are not required to have their hours tracked and logged on an itemized wage statement, commonly referred to as a pay stub.

Payroll

AB 1847 requires employers who must notify employees of their eligibility for the federal Earned Income Tax Credit to also notify these employees that they may be eligible for the California Earned Income Tax Credit. The bill updates the required notice that must be given to employees.

Challenges to Minimum Wage Violations

Under AB 2899, employers who contest a Labor Commissioner ruling that they failed to pay the minimum wage must post a bond equal to the unpaid wages, excluding penalties. The bond is issued in favor of the unpaid employees.

Local Wage Enforcement

Cities in California continue to pass local ordinances relating to the minimum wage and paid sick leave. Eligibility rules may vary from city to city. The minimum wage rates in these cities may change at any time; employers should closely monitor them. Check with your local city government as to whether any local minimum wage ordinance might apply to your workforce.

SB 1342 grants local officials or department heads the power to issue subpoenas and to report noncompliance with employment-related ordinances to local superior court judges. Note that the legislative intent of this new law further encourages cities and counties to enact measures to combat wage theft.

Janitorial Workers

AB 1978 enacts new recordkeeping, registration and training requirements for the janitorial industry. Many, but not all, of these provisions are delayed. The intent is to protect janitorial workers from wage theft and sexual violence or harassment:

• Effective January 1, 2017, covered janitorial employers must keep accurate records of daily hours worked, start and stop times, wages paid each payroll period, ages of minor employees and other required information. Records must be maintained for three years.

• Covered janitorial employers must register annually with the Labor Commissioner beginning July 1, 2018. AB 1978 sets forth registration fees and required information.

• The Division of Labor Standards Enforcement (DLSE) must develop a biennial, in-person sexual violence and harassment prevention training for employees and employers by January 1, 2019.

• Covered employers must provide employees with the Department of Fair Employment and Housing’s sexual harassment prevention pamphlet beginning July 1, 2018, and until the DLSE establishes the training requirement.

The bill includes civil fines for violations of the law. The Labor Commissioner is also given authority to adopt regulations to carry out the legislation.

Temporary Services; Wages

Under the Labor Code, wages are due and payable weekly to an employee of a temporary service employer, regardless of when the assignment ends. AB 1311 amends the Labor Code to make the weekly pay requirement apply to security guards employed by private patrol operators who are temporary services employers. This urgency legislation took effect on July 25, 2016.

| Discrimination and Retaliation Protections |

Several new laws expand employee protections for 2017.

Fair Pay

Last year, significant amendments were made to California’s equal pay laws to address gender wage inequality. This year, two new bills expand California’s fair pay laws.

SB 1063 expands the Fair Pay Act beyond gender wage inequality to address racial/ethnic wage disparity. The legislation prohibits an employer from paying any of its employees wage rates that are less than the rates paid to employees of another race or ethnicity for substantially similar work.

In addition, AB 1676 specifies that, under the Fair Pay Act, prior salary cannot, by itself, justify any disparity in compensation. The law is intended to “help ensure that both employers and workers are able to negotiate and set salaries based on the requirements, expectations, and qualifications of the person and the job in question, rather than on an individual’s prior earnings, which may reflect widespread, long-standing, gender-based wage disparities in the labor market.”

Harassment Prevention Training

AB 1661 requires local agency officials, including local elected officials, to receive sexual harassment prevention training and education whenever those officials receive any type of compensation, salary or stipend. By creating a specific training requirement for these officials, this law resolves any ambiguity over whether local elected officials are considered supervisory employees subject to California’s mandatory sexual harassment prevention training requirements.

Under AB 1661, local officials must undergo two hours of training within six months of taking office or starting employment and every two years thereafter. Local agencies must consult with the city attorney or the county counsel when developing the training. The requirements for this training differ from requirements under AB 1825 training.

See also the discussion of harassment prevention training for janitorial workers in the Wage and Hour section.

All-Gender Restrooms

Beginning March 1, 2017, all single-user toilet facilities in any business establishment, place of public accommodation or government agency must be identified as “all-gender” toilet facilities. The new law (AB 1732) also authorizes inspectors or other building or local officials responsible for code enforcement to inspect for compliance.

Immigration-Related Protections

Employers are required by federal law to verify an employee’s eligibility to work using the Form I-9 process. Under federal law, it is unlawful for employers to ask for more or different documentation than is required by the Form I-9, refuse to accept documents that appear genuine on their face or engage in other types of document abuse. SB 1001 makes this type of conduct unlawful under state law as well.

The legislation gives the Labor Commissioner power to enforce the law and specifies a penalty of up to $10,000 as well as the ability to issue orders to stop further violations. This new state law may provide an easier remedy than federal law for workers who believe they have had their rights violated.

Definition of Employee

AB 488 revises the definition of employee under California’s Fair Employment and Housing Act (FEHA) to authorize an individual employed under a special license in a nonprofit sheltered workshop, day program or rehabilitation facility to bring an action under the FEHA for any form of harassment or discrimination prohibited by the FEHA.

Human Trafficking

AB 1684 authorizes the Department of Fair Employment and Housing (DFEH) to receive complaints from victims of human trafficking. The DFEH can investigate, prosecute, mediate, conciliate and bring civil actions on behalf of these victims. Any damages awarded in a civil action go to the victim.

State Contracts and Anti-Discrimination Certification

Under AB 2844, those who bid, propose or renew a contract of $100,000 or more with a state agency must certify their compliance with the Unruh Civil Rights Act and FEHA.

Discrimination Regulations and Enforcement

SB 1442 consolidates various anti-discrimination regulations and enforcement and investigatory powers under the jurisdiction of the DFEH. It removes other state agencies’ authority to issue regulations prohibiting discrimination.

Confidential Age Information

AB 1687 is intended to address issues of age discrimination in the entertainment industry and allows individuals to, upon request, keep their birth date and/or age from being published on websites that provide employment services to the industry.

| Leaves of Absence and Benefits |

Several new laws expand benefits for leaves of absences and one new law creates a state-run retirement plan for private sector workers.

Paid Family Leave Benefits

Beginning January 1, 2018, AB 908 increases the amount of paid family leave benefits an employee can receive to either 60 percent or 70 percent of earnings, depending on the employee’s income. Currently, employees may receive 55 percent of earnings. Under the new law, there still will be a maximum weekly benefit limit on the amount received.

Effective January 1, 2018, the new law will also remove the current seven-day waiting period that exists before an employee is eligible to receive PFL benefits.

Domestic Violence, Sexual Assault and Stalking Protections

AB 2337 requires employers with 25 or more employees to provide employees with written notice about the rights of victims of domestic violence, sexual assault and stalking to take protected time off for medical treatment or legal proceedings.

A required form must be given to all new employees when hired and to current employees upon request. The Labor Commissioner is required to develop the form on or before July 1, 2017. Employers are not required to comply with this notice requirement until the Labor Commissioner posts the new form on its website.

Private Retirement Savings Plans

SB 1234 approves the California Secure Choice Retirement Savings Program (SCRSP), which is a state-run retirement plan for private sector workers. The legislation sets forth specific prerequisites that must be met before the SCRSP can be implemented. It may be some time before we actually see this program up and running.

Under the legislation, employers with five or more employees that do not offer specified retirement plans must put a payroll arrangement into place so that employees may contribute a portion of their salary or wages to a retirement saving program in the SCRSP. Employers retain the right at all times to set up and offer their own qualified retirement plan. Employees’ ability to participate will be phased in based on the size of the employer.

Employers will have some administrative duties, including: allowing employees to make automatic contributions from their paychecks; transmitting payroll contributions; and distributing state developed administrative materials.

The legislation also provides employers with specified immunity from civil liability.

Paid Sick Leave

SB 3 extends California’s paid sick leave law to cover in-home supportive services workers beginning July 1, 2018. The amendments also set forth a specific amount of paid sick leave that must be provided to these workers, which is different from the amount provided to other California employees.

AB 2393 provides specific rules relating to the interaction of sick leave and parental leave for school district employees working in positions requiring certification qualifications.

Disability Benefits

AB 2886 extends the appeal time for disability benefits from 20 to 30 days, effective March 1, 2018.

| Background Checks |

Two new laws affect how background checks are conducted.

Juvenile Criminal History Information

AB 1843 prohibits employers from inquiring into an applicant’s juvenile convictions or using such convictions as a factor in determining any condition of employment.

Specifically, the legislation prohibits employers from inquiring into any “adjudication” made by the juvenile court, including crimes listed under Welfare and Institutions Code Section 707(b) (e.g., murder, arson, rape, kidnapping, discharge of a firearm). “Adjudication” is a final determination by a court as to whether the juvenile committed the crime of which he or she is accused.

For health care facilities, AB 1843 allows employers to inquire into juvenile adjudications for felony or misdemeanor sexual offenses or drug possessions within the prior five years.

Criminal Background Check – Ride Sharing Services

AB 1289 requires a “transportation network company” (think Uber and Lyft) to conduct, or have a third party conduct, a local and national criminal background check for each participating driver.

AB 1289 prohibits a transportation network company from contracting with, employing or retaining a driver if the driver, among other things, is currently registered on the United States DOJ’s National Sex Offender Public Website; was convicted of certain terrorism-related felonies or a defined violent felony, or, within the previous seven years, was convicted of any misdemeanor assault or battery, any domestic violence offense, driving under the influence of alcohol or drugs, or any of a specified list of felonies.

| Workplace Safety |

Several new laws affect workplace safety, including one that took effect June 9, 2016.

Indoor Heat Illness

SB 1167 requires Cal/OSHA, to propose a heat-illness and injury prevention standard for indoor workers by January 1, 2019. SB 1167 does not specify what provisions will be included in the new rule or what types of workplaces will be covered — potentially the new rule could include all indoor workplaces, including air conditioned offices. Employers will be able to offer comments during a rulemaking process.

Driving

AB 1785 clarifies rules relating to the use of wireless electronic devices while driving. The legislation reaffirms the general ban on using such devices, but amends existing law to authorize drivers to use their hand to activate or deactivate a feature or function of the device with a single swipe or tap, as long as the device is mounted so as not to hinder the driver’s view of the road.

Smoking

A package of bills was signed earlier this year that extend the ban on workplace smoking. These rules took effect June 9, 2016.

Litigation

One new law affects employment agreements.

Choice of Forum; Choice of Law

Under SB 1241, an employer cannot require an employee who primarily works and resides in California to agree to:

• Adjudicate a claim in another state when the claim arises in California (prohibiting choice of forum).

• Apply another state’s law to a controversy that arises in California (prohibiting choice of law).

This legislation applies to all employment agreements, such as executive contracts and arbitration agreements that are entered into, modified or extended on or after January 1, 2017. It will affect multi-state employers and out-of state employers that have employees in California.

| Workers’ Compensation |

Several bills relating to workers’ compensation were signed into law in 2017:

SB 1160 and AB 2503:

• Make changes to the utilization review process with respect to injuries occurring on or after January 1, 2018.

• Require regulations to be adopted to provide employees with notice that they may access medical treatment outside the workers’ compensation system following the denial of their claim.

• Make changes regarding liens filed after January 1, 2017.

• Amend the reporting and request for authorization requirements for physicians who attend to ill or injured employees.

AB 1244 requires prompt suspensions of physicians, practitioners or providers from participating in the workers’ compensation system if the individual meets certain criteria; for instance, if the individual was convicted of any felony or misdemeanor involving abuse of the Medi-Cal or Medicare programs or the workers’ compensation systems.

AB 2883 clarifies when owners or officers of businesses may be excluded from workers’ compensation laws.

SB 914 deletes the authorization to use the American College of Occupational and Environmental Medicine as a standard for independent medical reviews.

SB 1175 requires providers to submit bills for medical services to the employer within one year of the date of service.

Public Works and Prevailing Wages

A number of new laws relate to public works and prevailing wages. Employers who provide services or construction work on public works projects for the government or public-sector entities must pay the prevailing wage, which is usually significantly higher than the minimum wage.

The bills include:

• AB 326: Requires the Department of Industrial Relations to release funds held pending a prevailing wage determination back to the contractors who deposited them within 30 days after the conclusion of the proceeding or receiving written notice from the Labor Commissioner of final disposition. Interest must be included.

• AB 1926: Requires employers to pay apprentices who are dispatched to perform work on public works projects and required to undergo pre-employment activities, such as testing or training, the prevailing wage for the time spent on the pre-employment activity, including travel time.

• SB 954: Limits the ability for a non-union contractor to receive a credit for certain payments made against the prevailing wage. Specified prevailing wage benefit payments are allowed only if made by an employer “obligated under a collective bargaining agreement.”