理财| 【外国人赠予】没有美国身分的家人要赠与给有美国身分的我....I 美国泛宇集团-地产、贷款、保险、投资、税务

09/27/2021 美國泛宇集團

最近有很多有美国身份的海外朋友在咨询,如果他们有家人要赠与他们资产,会不会有赠与税的问题? 有什么应该要注意的地方?

首先,要看海外人士赠与的是什么?

如果他是赠与美国的房地产,绝对是有赠与税的问题,但是, 如果他要赠与美国以外的房地产就没有赠与税的问题。很多时候,大部分的海外人士赠与的基本上都是金钱,如果是这样的话,他可以从海外就把这个赠与的动作做完,比如说这个美国人在国内有一个户口,那他可以在国内的户口来收这笔赠与,在美国国税局的角度来说,这个海外的赠予是应该在海外来完成的,这个是最好的方式。另外一个方式,他可以直接打到美国人的账户,如果金额在十万或以上的时候,他需要来报一个3520表格(不到十万则不用),这个是以一年来计算的。

华人家长要给孩子房子或是大额现金怎么做?

01

现金:

我们不建议家长在美国来作现金赠与,为什么呢?比如说妈妈在美国有一个一百万的银行户口,但是她没有美国人的身份,而儿子是有美国人身份的,如果妈妈在美国把户口的钱打到他儿子的账户,这个在国税局严格说来算是一个赠与。虽然外国人和美国人一样,一年可以赠予一万五千,但多出来的九十八万五还是要打赠与税的。

02

房子:

没有美国身份的家长在美国买了房子,然后孩子在美国读书,之后找工作获得美国身份。如果这时家长想把房子过户给孩子,当他这么做的时候,就铁定有赠与税的问题。上面提过,外国人的赠与,一年只有一万五的额度,如果是赠与整套房子,按照市价来算,肯定会超过很多,所以要付赠与税是避免不了的。

想要把自己的资产从亚洲带到美国来,是否有赠与的问题?

如果是自己的财产是没有赠与的问题,但是要注意肥爸(FBAR)、肥咖 (FATCA)这两个方面。如果您在国外银行的户口或者金融资产全部加起来,超过一万的话,要报一个114的表格;要是超过五万的话,要报一个8938的表格。这个就是您向国税局透露您美国以外的金融资产,因为您是有美国身份的,如果已经透露过,那这些钱便可以直接打进来,就不算是赠与。

小结:

如果您想要给下一代一些资产或是有海外的资产,难免会产生税的问题、资金打款的问题、还有相关的法令规定的问题,一定需要跟專業在地的稅務團隊溝通,美国泛宇集团有非常专业的税务团队可以帮您解决各式各样的资产还有税上规划的问题。

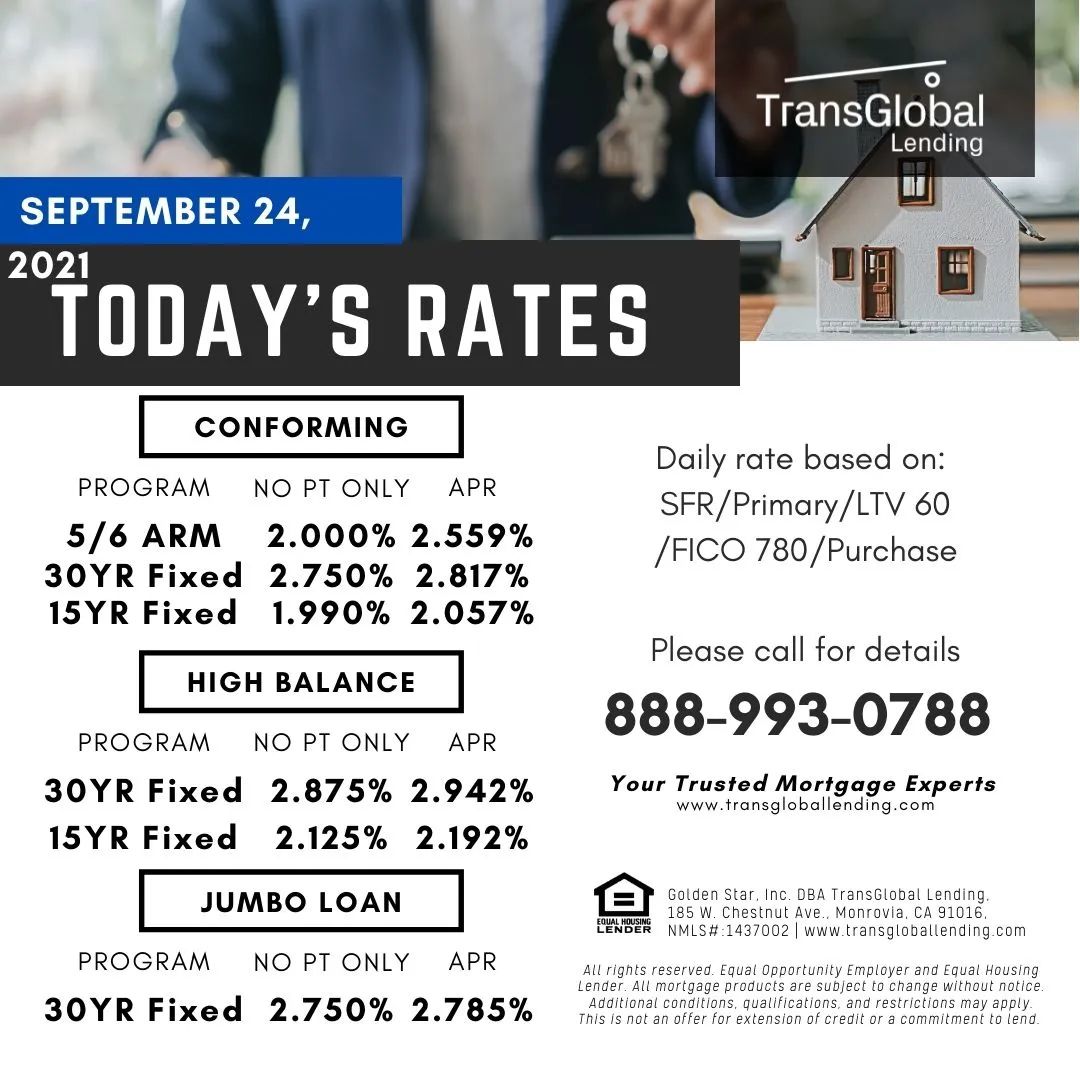

IMPORTANT: Advertised rates were valid and effective as of the date reflected above, are for informational purposes only, and are subject to change without notice.

Loans are subject to credit and collateral approval. Advertised rates are based on a set of loan assumptions including a borrower with excellent credit history and optimal loan characteristics. Your final interest rate and annual percentage rate (APR) may differ depending on your individual transaction's specific characteristics, and certain products may not be available for your situation. Several determining factors include, but are not limited to, the state of the property location, loan amount, documentation type, loan type, occupancy type, property type, loan to value, and credit score.

APR reflects the cost of credit over the term of the loan expressed as an annual rate. For mortgage loans, APR may include the interest rate, discount points (also referred to as "points"), and other charges or fees (such as mortgage insurance and origination fees), but does not necessarily take into account other loan-specific finance charges you may be required to pay.

Investment securities products and services are offered through Globalink Securities, Inc. (GSI) and TransGlobal Advisory, LLC. (TGA). GSI is member of FINRA & SIPC, which is a separate registered broker-dealers and non-bank affiliates of TransGlobal Holding Company. Portfolio management and advisory services are provided by TGA, a registered investment advisor and subsidiary of TransGlobal Holding Company.

Investment and brokerage products are:

Not FDIC Insured • No Bank Guarantee • May Lose Value

关注我们

微信号|FanyuUSA

新浪微博|泛宇一站式大讲台