【理財】|华人的理财思维可能跟不上新的税改?| 美国泛宇集团--地产、贷款、保险、投资、税务

12/20/2021 美國泛宇集團

因为增税的关系,大家现在对税的概念了解得越来越多了。

但,华人朋友在税务方面仍然有一些固有思维可以做修改,众所皆知,在美华人勤劳又聪明,尤其在Silicon Valley一带很多都是华人菁英。英文精通在自己专业上皆为翘楚,但是在财务与税务规划方面,还是有一些迷思。

迷思有哪些呢?

精英们共同的特点是善于投资,且注意回报。但是一到交税的时候,就无法淡定了,因为回报好,税也跟着涨高。第一个,他们喜欢玩股票,但是常常都用税后的钱去操作,这样短期资本利得要交很高,等到加税的时候可能交得更高,而长期资本利得交的也不少,特别是住在加州的人。

第二个,喜欢投资房地产者,却没注意到税上的好处,不喜欢贷款。华人的观念就是“无债一身轻”,可是这个观念到底是好还是不好呢?

讲个小故事,有位老公看他老婆每次煎鱼的时候都要去头去尾,那他就问老婆为什么要这样做,他老婆说不知道,因为她妈妈也是这样做的。然后,他又去问她岳母,为什么要把鱼掐头去尾,岳母说不知道,因为外婆都这样做的,最后,问到外婆那里,终于知道外婆这样做的原因是,家里锅子小,鱼装不下,所以才掐头去尾,但这方法就一路影响到现在。所以,有些概念可能在不同时期、不同的地方,会有不同的做法。

今天不想贷款的原因就是怕将来有负担,或将来有不好的情形。可是在美国,如果投资房地产不贷款真的是浪费了,如果贷款的话,首先可以杠杆,你100万去买100万,房租还要付税,将来100万翻一倍变200万,你等于是拿100万去赚100万。可是,同样的钱,你拿100万去买个300万的Property,所有的贷款利息可以抵税,所有的Property tax也可以抵税,因为300万抵得多,折旧也多,房租常常有可能根本不用交税。卖的时候还可以用1031来交换,更重要的是,你拿100万去买300万,如果翻一倍就变600万,你等于是拿100万去赚300万,这样看,不仅平时税上的规划变好了,翻倍的杠杆也变多了。

总的来说,要想投资回报好,税务规划少不了。投资股票,尽量用退休账户的钱去投资,而投资房产尽量使用贷款。另外,再去投资一些,像人寿保险、年金,这些本身对税务就有好处的理财工具,减轻投资的税务负担,让净所得变更多。

/

1

/

在升息以及变种病毒可能影响经济成长的新闻下,今日美股三大指数下跌,标普500下跌1%,道琼工业指数下跌1.5%,纳斯达克综合指数下跌0.1%。

/

2

/

除了新闻影响外,周五是所谓的四巫日 - 也就是个股选择权、股指期货、个股期货以及指数选择权到期的日子,通常在四巫日市场波动较为剧烈。

/

3

/

在个股方面,在家工作/生活类的股票表现较佳,Zoom Video上涨9.5%,Peloton上涨6.6%,Moderna则上涨4.5%。

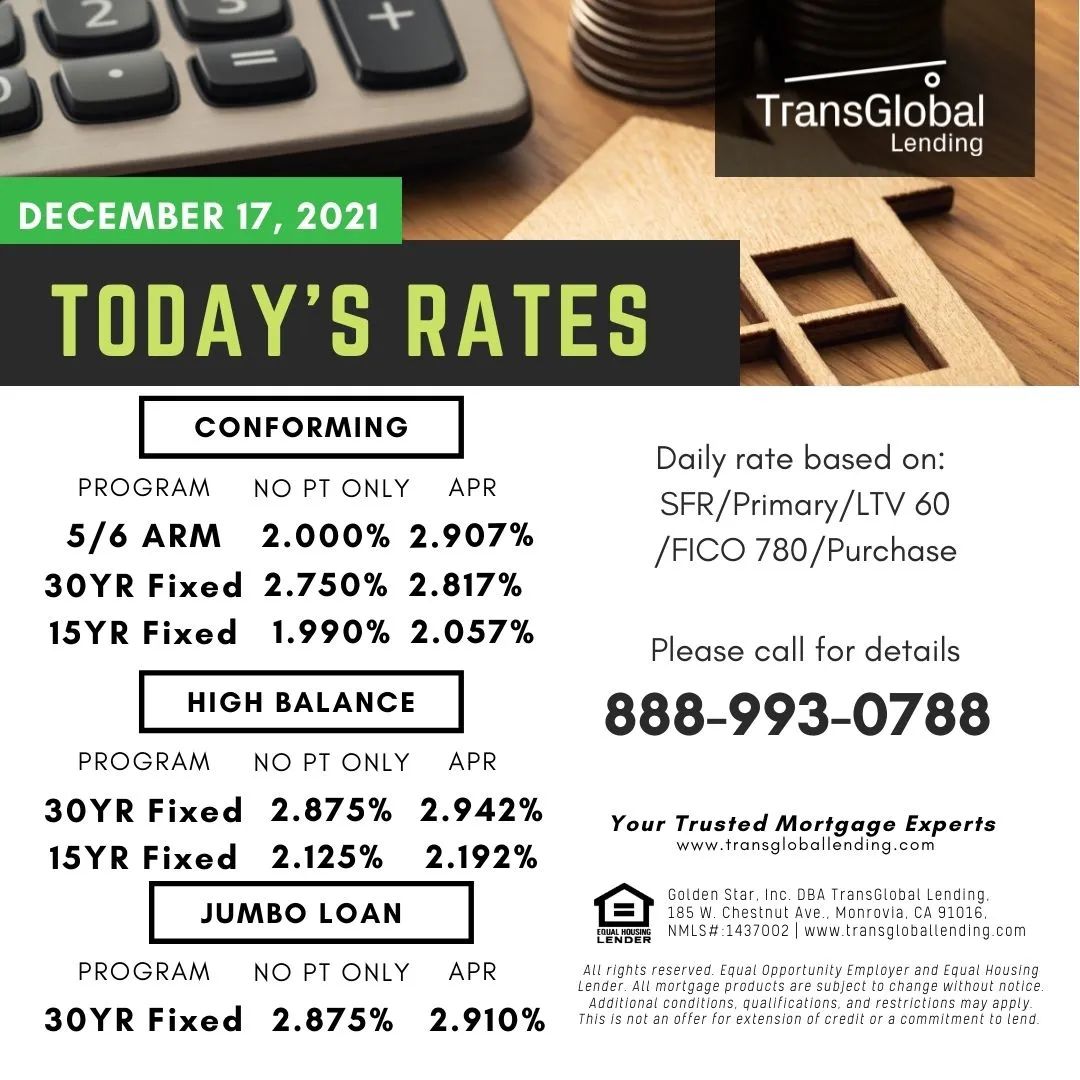

IMPORTANT: Advertised rates were valid and effective as of the date reflected above, are for informational purposes only, and are subject to change without notice.

Loans are subject to credit and collateral approval. Advertised rates are based on a set of loan assumptions including a borrower with excellent credit history and optimal loan characteristics. Your final interest rate and annual percentage rate (APR) may differ depending on your individual transaction's specific characteristics, and certain products may not be available for your situation. Several determining factors include, but are not limited to, the state of the property location, loan amount, documentation type, loan type, occupancy type, property type, loan to value, and credit score.

APR reflects the cost of credit over the term of the loan expressed as an annual rate. For mortgage loans, APR may include the interest rate, discount points (also referred to as "points"), and other charges or fees (such as mortgage insurance and origination fees), but does not necessarily take into account other loan-specific finance charges you may be required to pay.

Investment securities products and services are offered through Globalink Securities, Inc. (GSI) and TransGlobal Advisory, LLC. (TGA). GSI is member of FINRA & SIPC, which is a separate registered broker-dealers and non-bank affiliates of TransGlobal Holding Company. Portfolio management and advisory services are provided by TGA, a registered investment advisor and subsidiary of TransGlobal Holding Company.

Investment and brokerage products are:

Not FDIC Insured • No Bank Guarantee • May Lose Value