21世紀房地產公司─朱永琪Yongqi Zhu《市場快報》

地產

時間:06/20/2014

瀏覽: 747

Don’t get frightened by the headline numbers

Several economic and housing numbers released this week may cause some to rethink the economic recovery. Nevertheless, it’s necessary to dig deeper into components of measures before jumping to conclusions. For example, revised GDP figures suggested that GDP declined at 1.0 percent rate in the first quarter of 2014. The key driver of the downward revision was a much larger negative change in private inventories. This was payback from the positive contribution in the third quarter of last year. Change in private inventories tends to bounce around quarter-to-quarter. There were also downward revisions to investment in nonresidential structure, trade, and state and local government. Nevertheless, this weakness in the economy will not continue since growth has already picked up in the second quarter and most indicators suggest strong rebound. Experts expect both residential investment and state and local governments to add to growth soon. And even investment in nonresidential structures should turn positive.

Also, for the improvement in the housing numbers, employment growth is the necessary and most important factor. In California, employment growth has gained substantial momentum over the past couple of years. While San Francisco remains the leader with growth in technology sector, other geographic areas and industries follow closely. Fortunate for the housing sector, most of the recent improvement has come from construction. Construction payrolls have been growing over the last few years, and although still a shadow of where it previously rested, rebound in homebuilding and construction employment is boding well for California’s economy and the housing market.

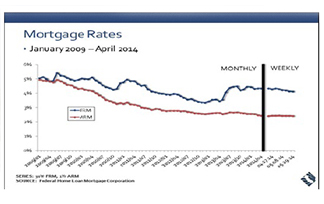

While an increase in homebuilding is much welcomed for the constrained inventory of homes for sale, there are couple other developments that should aid the spring home-buying season. Firstly, mortgage interest rates continue to decline with average rates on fixed mortgages falling for five straight weeks. Secondly, inventory of homes for sale in April increased 6.1 percent from March 2014 and increased 19.5 percent from a year ago. The supply of homes for sale improved in all price segments when compared to the same month last year, but remained tight in the lower price segment. Inventory for homes priced below $300,000, for example, continues to be most significantly constrained but has inched up slightly by 0.8 percent from April 2013, a first increase after a long time.

Improved inventory of homes for sales and lower mortgage rates should be enticing for those buyers who have been sitting on sidelines and waiting for the winter lull to pass by. Home sales already show signs of improvement. April’s jump of 7.4 percent in existing single-family home sales was significantly higher than the -1.8 percent change from March to April recorded in the long run.

Several economic and housing numbers released this week may cause some to rethink the economic recovery. Nevertheless, it’s necessary to dig deeper into components of measures before jumping to conclusions. For example, revised GDP figures suggested that GDP declined at 1.0 percent rate in the first quarter of 2014. The key driver of the downward revision was a much larger negative change in private inventories. This was payback from the positive contribution in the third quarter of last year. Change in private inventories tends to bounce around quarter-to-quarter. There were also downward revisions to investment in nonresidential structure, trade, and state and local government. Nevertheless, this weakness in the economy will not continue since growth has already picked up in the second quarter and most indicators suggest strong rebound. Experts expect both residential investment and state and local governments to add to growth soon. And even investment in nonresidential structures should turn positive.

Also, for the improvement in the housing numbers, employment growth is the necessary and most important factor. In California, employment growth has gained substantial momentum over the past couple of years. While San Francisco remains the leader with growth in technology sector, other geographic areas and industries follow closely. Fortunate for the housing sector, most of the recent improvement has come from construction. Construction payrolls have been growing over the last few years, and although still a shadow of where it previously rested, rebound in homebuilding and construction employment is boding well for California’s economy and the housing market.

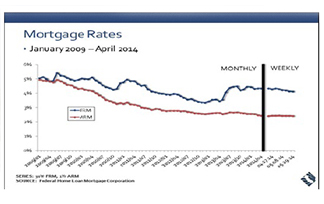

While an increase in homebuilding is much welcomed for the constrained inventory of homes for sale, there are couple other developments that should aid the spring home-buying season. Firstly, mortgage interest rates continue to decline with average rates on fixed mortgages falling for five straight weeks. Secondly, inventory of homes for sale in April increased 6.1 percent from March 2014 and increased 19.5 percent from a year ago. The supply of homes for sale improved in all price segments when compared to the same month last year, but remained tight in the lower price segment. Inventory for homes priced below $300,000, for example, continues to be most significantly constrained but has inched up slightly by 0.8 percent from April 2013, a first increase after a long time.

Improved inventory of homes for sales and lower mortgage rates should be enticing for those buyers who have been sitting on sidelines and waiting for the winter lull to pass by. Home sales already show signs of improvement. April’s jump of 7.4 percent in existing single-family home sales was significantly higher than the -1.8 percent change from March to April recorded in the long run.

图片翻摄自网路,版权归原作者所有。如有侵权请联系我们,我们将及时处理。

打開微信,使用 “掃描QR Code” 即可將網頁分享到我的朋友圈。

點評

點評 微信

微信 微博

微博